Brian Gaynor at the Herald has an interesting column on foreign ownership this week. The BNZ figures prominently in the story as a case study in how not to bring foreign investment into the country.

Brian Gaynor at the Herald has an interesting column on foreign ownership this week. The BNZ figures prominently in the story as a case study in how not to bring foreign investment into the country.

Gaynor also quotes John Stewart, CEO National Australia Bank (which now owns the BNZ), who recently told the Australian Financial Review that the Australian Government shouldn’t allow foreign takeovers of the four main banks because;

“Australia might end up as a branch economy, not dissimilar to the way New Zealand is now.”

It raises some interesting questions if the CEO of an Australian company that owns a major and significant New Zealand business does not want his Australian company to end up like his New Zealand one; How much does he care about that New Zealand company and what is he doing to address his concerns?

While it would be nice for New Zealand to own its on major strategic banks, that horse may well have bolted. It’s helpful to remember though that foreign investors are guests here using our resources and workers to turn a profit – much of which they often take back overseas with them. Foreign investors have a valuable role to play in our economy, but they need to go about it responsibly making sure that kiwis benefit from the exchange too.

For Finsec this raises two issues. The first is whether the Reserve Bank needs to improve its provisions in relation to purchase and sale of banks by including stronger national interest considerations. The second issue is that important economic banking decisions are now made in Sydney not Auckland. These include decisions not just about the working conditions and well being of bank workers, but also about important Better Banks issues like the the quality of customer service, investment back in local communities and bank’s responsibilities to the country is which they do business. What does this mean for the kind of union that Finsec needs to be to influence these decisions?

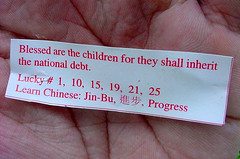

(thanks to wonderferret for the photo and a hat-tip to frogblog)

The Reserve Bank appeared to reflect Finsec sentiments earlier this week when it argued that

The Reserve Bank appeared to reflect Finsec sentiments earlier this week when it argued that

2007 has begun with continued debate about monetary policy. On the one hand, the housing market in particular (and some economists argue the tight labour market also) imply that interest rates should rise, whereas other economists are arguing that the easing rate of annual inflation along with a higher exchange rate and modest GDP growth justify holding the official cash rate at 7.25%.

2007 has begun with continued debate about monetary policy. On the one hand, the housing market in particular (and some economists argue the tight labour market also) imply that interest rates should rise, whereas other economists are arguing that the easing rate of annual inflation along with a higher exchange rate and modest GDP growth justify holding the official cash rate at 7.25%.

Recent Comments